Meal Card Programs: The Ultimate Guide for Businesses

September 25, 2024 in Blog

Explore the world of meal card programs, including their benefits, types, implementation steps, and tax implications.

Did you know that offering employee meal cards can lead to a significant boost in employee satisfaction and retention? In today's competitive job market, businesses are constantly searching for ways to attract and retain top talent. Employee meal cards have emerged as a popular and effective benefit that not only enhances employee well-being but also provides substantial tax advantages for both employers and employees. This comprehensive guide will explore the various facets of employee meal cards, from their different types and benefits to the steps involved in implementing a successful program.

An employee meal card is a prepaid or voucher-based system that allows employees to purchase food and beverages at designated merchants, typically restaurants, cafes, and food delivery services. These cards function as a convenient alternative to cash or personal credit cards, simplifying mealtime for employees and offering a range of advantages for both individuals and organizations.

Employee meal cards offer a win-win situation for everyone involved. Employees enjoy tax-free meal allowances, wider food choices, and easier expense management. Meanwhile, employers benefit from increased employee morale, reduced administrative burden, and potential cost savings compared to traditional meal allowance methods.

Let's explore the different types of employee meal cards and the specific benefits they offer to both employees and employers.

Types of Employee Meal Cards

Employee meal card programs offer various options to cater to the specific needs of businesses and their employees. Understanding the different types of meal cards available is crucial for selecting the program that best aligns with your company's objectives and employee preferences. Here are some common types of employee meal cards:

1. Prepaid Meal Cards

Prepaid meal cards are the most popular type of employee meal card. They work similarly to debit cards, where employers preload a fixed amount onto the card, which employees can use to purchase food and beverages at participating merchants. These cards offer employees flexibility and choice, as they can use them at various establishments within the card network.

Features of Prepaid Meal Cards:

- Preloaded Balance: Employers determine the amount loaded onto the card, often on a monthly or bi-weekly basis.

- Wide Acceptance: These cards are generally accepted at a wide range of restaurants, cafes, grocery stores, and food delivery apps.

- PIN Protection: Most prepaid meal cards have PIN protection for added security.

- Online and Offline Usage: Employees can use prepaid meal cards for both online and offline transactions.

- Balance Tracking: Employees can easily track their balance and transaction history through online portals or mobile apps.

Benefits of Prepaid Meal Cards:

- Convenience: Employees no longer need to carry cash or worry about splitting bills for group lunches.

- Flexibility: Employees have the freedom to choose where and what they want to eat.

- Budgeting: The preloaded balance helps employees budget their food expenses.

- Reduced Administrative Burden: Employers can streamline the process of disbursing meal allowances.

Limitations of Prepaid Meal Cards:

- Limited to Participating Merchants: Usage is restricted to merchants within the card network.

- Potential for Loss or Theft: Like any physical card, prepaid meal cards can be lost or stolen. However, most providers offer easy card replacement options.

2. Employer-Issued Cards

Some companies opt for employer-issued cards that are specifically designed for use at a select group of partner restaurants or food service providers. These cards offer exclusive discounts and deals at those establishments but have limited usage elsewhere.

Features of Employer-Issued Cards:

- Partner Network: Employers partner with specific restaurants or food vendors to create a limited network for card usage.

- Exclusive Deals: Employees can enjoy discounts or special offers at partner establishments.

- Spending Controls: Employers can set spending limits for each vendor or category.

Benefits of Employer-Issued Cards:

- Cost Savings: Employers can negotiate favorable rates with partner merchants.

- Employee Satisfaction: Exclusive deals and discounts can enhance employee satisfaction.

- Supports Local Businesses: Partnerships with local restaurants and businesses can benefit the community.

Limitations of Employer-Issued Cards:

- Limited Choice: Employees have fewer options for where they can use the card.

- Negotiations Required: Employers need to establish partnerships with merchants.

3. Restaurant Cards

Restaurant cards are specifically for use at the company's in-house cafeteria or dining facilities. These cards provide employees with a convenient way to pay for meals within the company premises.

Features of Restaurant Cards:

- In-House Usage: These cards are only valid at the company's designated dining areas.

- Cashless Payment: Employees can pay for meals without cash or personal cards.

- Prepaid or Deduction System: Companies can choose to preload the cards or deduct the cost of meals from employee salaries.

Benefits of Restaurant Cards:

- Convenience for Employees: Easy access to meals within the workplace.

- Cost Control for Employers: Companies can manage food costs more effectively.

- Promotes In-House Dining: Encourages employees to utilize company dining facilities.

Limitations of Restaurant Cards:

- Limited Usage: These cards are not valid outside of the company's premises.

- May Not Offer Variety: Employees may have limited food choices depending on the company's dining options.

Digital Meal Cards

In addition to physical cards, many meal card providers now offer digital meal cards that can be stored in mobile wallets or accessed through dedicated apps. These cards function similarly to physical cards but offer added convenience and security.

Benefits of Digital Meal Cards:

- Enhanced Security: Reduced risk of loss or theft compared to physical cards.

- Instant Issuance: Employers can issue digital cards instantly to new employees.

- Seamless Integration: Digital cards can be easily integrated with mobile payment systems.

Choosing the Right Type of Meal Card

The best type of employee meal card for your company depends on various factors, including your budget, employee preferences, and the availability of dining options in your area. It's essential to carefully consider the features, benefits, and limitations of each type of card before making a decision.

Table Comparing Different Types of Employee Meal Cards:

|

Type of Card |

Features |

Benefits |

Limitations |

|

Prepaid Meal Cards |

Preloaded balance, wide acceptance |

Convenience, flexibility, budgeting, reduced admin burden |

Limited to participating merchants, risk of loss or theft |

|

Employer-Issued Cards |

Partner network, exclusive deals |

Cost savings, employee satisfaction, supports local businesses |

Limited choice, negotiations required |

|

Restaurant Cards |

In-house usage, cashless payment |

Convenience, cost control, promotes in-house dining |

Limited usage, may not offer variety |

|

Digital Meal Cards |

Enhanced security, instant issuance, integration |

Convenience, security, seamless integration with mobile payment systems |

Requires employees to have smartphones or access to mobile wallets |

By carefully evaluating the different types of employee meal cards and considering the specific needs of your organization and your workforce, you can choose the most effective and suitable option to enhance employee satisfaction and optimize your benefit programs.

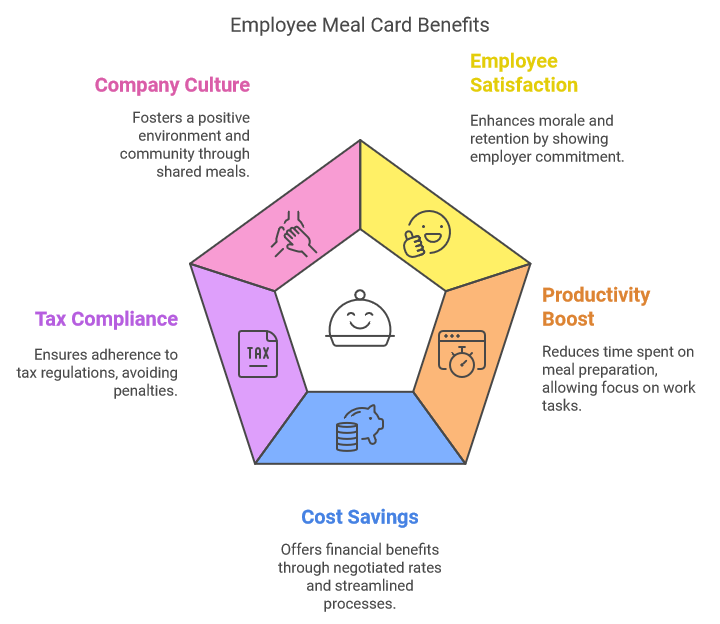

Benefits of Employee Meal Cards

Employee meal cards offer a wide array of benefits for both employees and employers. Let's examine how these programs can contribute to a positive work environment and a more satisfied and productive workforce.

Advantages for Employees

- Tax Savings: One of the most significant advantages of employee meal cards is the tax benefits they provide. In many countries, including India, meal allowances provided through meal cards are exempt from income tax up to a certain limit. This means employees can save a considerable amount on taxes each year, effectively increasing their take-home pay. For example, in India, employees can save up to Rs. 30,000 annually by utilizing meal cards for their food expenses.

- Convenience and Ease of Use: Meal cards eliminate the need for employees to carry cash or use personal credit cards for food purchases. They can conveniently pay for meals at a wide range of establishments, including restaurants, cafes, and online food delivery platforms. This convenience simplifies mealtime, reduces the hassle of managing cash, and allows employees to focus on their work.

- Wider Food Choices: With meal cards, employees have access to a broader selection of dining options compared to traditional meal voucher systems or in-house cafeterias. They can choose from various restaurants, cuisines, and food delivery services, promoting a more enjoyable and fulfilling dining experience.

- Improved Health and Nutrition: Meal card programs can encourage employees to make healthier food choices. By partnering with vendors offering nutritious meal options, employers can promote employee well-being and potentially reduce healthcare costs in the long run.

- Better Budgeting and Expense Management: The preloaded balance on meal cards helps employees manage their food expenses more effectively. They can track their spending and make informed decisions about their meal choices, promoting responsible budgeting and financial control.

Illustrative Example: Imagine an employee who frequently struggles with finding time to pack lunch or grab a healthy meal during their busy workday. With an employee meal card, they can conveniently order food from a nearby restaurant or utilize a food delivery app, ensuring they have access to nutritious meals without sacrificing their work time or compromising their well-being.

Advantages for Employers

- Enhanced Employee Satisfaction and Retention: By providing meal cards as a valuable benefit, employers demonstrate a commitment to employee well-being. This can lead to increased employee satisfaction, improved morale, and a higher likelihood of retaining valuable talent. A study by Sodexo found that companies offering meal benefits experienced a 10% higher employee retention rate compared to those that did not [information from outside source].

- Increased Productivity: When employees have convenient access to meals, they are less likely to spend excessive time searching for food or preparing meals at home. This can result in increased productivity, as employees can focus on their work tasks without interruptions or distractions related to mealtime.

- Cost Savings and Administrative Efficiency: Employee meal card programs can potentially lead to cost savings for employers compared to traditional meal allowance methods. By negotiating favorable rates with meal card providers and partner merchants, companies can reduce overall expenses. Additionally, meal cards streamline the administration of meal allowances, eliminating the need for manual reimbursements or the handling of physical vouchers.

- Compliance with Tax Regulations: Utilizing meal card programs helps ensure compliance with tax regulations related to employee meal allowances. The structured and documented nature of these programs makes it easier for companies to adhere to tax laws and avoid potential penalties.

- Improved Company Culture: Offering meal cards can contribute to a more positive and engaging company culture. It demonstrates that the company cares about employee well-being and promotes a sense of community by facilitating shared meal experiences.

In conclusion, employee meal cards offer a comprehensive solution that benefits both employees and employers. By understanding the various types of meal cards available and their specific advantages, companies can implement programs that effectively enhance employee satisfaction, streamline administrative processes, and foster a more productive and positive work environment.

Meal Cards: A Boost to Morale and Savings

Meal cards have emerged as a popular employee benefit, contributing to increased employee morale and offering attractive tax savings.

Improving Employee Morale:

- Reduced Financial Stress: Meal cards alleviate the financial burden of daily food expenses, allowing employees to allocate their income to other essential needs. This reduction in financial stress can lead to improved overall well-being and job satisfaction.

- Feeling Valued and Appreciated: When employers provide meal cards, employees perceive it as a gesture of care and appreciation. This can foster a sense of loyalty and belonging within the company.

- Convenient and Hassle-Free: The convenience of using meal cards for food purchases, both online and offline, eliminates the need for employees to carry cash or worry about reimbursements. This hassle-free experience contributes to a more positive work environment.

- Wider Food Choices: Unlike limited in-house cafeteria options, meal cards provide employees with the freedom to choose from a diverse range of restaurants and cuisines. This flexibility caters to individual preferences and dietary needs, promoting greater satisfaction.

Tax Benefits in India:

- Income Tax Exemption: Under Section 17(2)(viii) of the Income Tax Act, meal allowances provided through meal cards are exempt from tax up to a certain limit. This exemption reduces the taxable income of employees, leading to significant tax savings.

- Potential Savings: In India, the current monthly exemption limit for meal allowances is Rs. 2,500. This translates to a potential annual tax saving of Rs. 30,000 per employee.

- Employer Benefits: Employers also benefit from providing meal allowances through meal cards, as it reduces their overall payroll tax liability.

By offering meal cards, companies demonstrate a commitment to employee well-being, leading to a more motivated and satisfied workforce. The added tax benefits further enhance the appeal of this employee benefit, making it a win-win situation for both employers and employees.

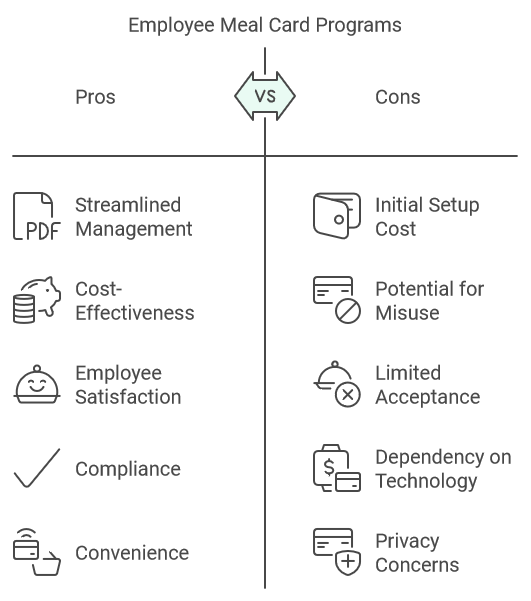

Advantages and Disadvantages of Meal Cards for Employers

The sources provide information on how meal cards can benefit employees and employers, including tax advantages, security, and increased convenience. However, there is limited information on the specific disadvantages of implementing a meal card program for employers.

Advantages for Employers:

- Employee Retention: Providing meal cards as part of an employee benefits package can be a great way to attract and retain talent. They are a valuable perk that employees appreciate, making them more likely to stay with the company.

- Increased Productivity: Meal cards can help employees save time and focus on their work by eliminating the need to prepare meals or spend time searching for food options.

- Streamlined Administration: Meal cards simplify the process of managing meal allowances. Digital meal card systems make it easier for finance teams to distribute funds, track spending, and generate reports, eliminating the hassle of paper-based food coupons.

- Competitive Advantage: Offering meal cards can set a company apart from its competitors, especially when vying for talent in a competitive job market.

- Cost Savings: Meal cards can offer cost savings to employers through bulk discounts from meal card providers and partner merchants. This is particularly beneficial for companies with a large number of employees.

Disadvantages of Meal Cards:

While the sources highlight numerous benefits, it's important to acknowledge potential drawbacks:

- Limited Merchant Acceptance: Meal cards may not be accepted at all food establishments, restricting employee choices. This can be a disadvantage if the network of accepted merchants is limited in a particular area.

- Implementation Costs: Setting up and implementing a meal card program can involve initial costs, such as card issuance fees and platform integration charges. Employers need to carefully assess these costs and weigh them against potential benefits.

- Employee Preference: Not all employees may find meal cards beneficial, as they might prefer cash allowances or a wider range of dining options. Companies should consider employee preferences and potentially offer alternative benefit options.

- Technical Issues: Digital meal card systems can experience technical glitches or outages, disrupting employee access to funds.

Overall, meal cards offer a convenient and cost-effective way to provide meal allowances to employees. However, employers should carefully consider the potential disadvantages and choose a meal card provider that offers a wide network of merchants, reliable technology, and flexible options to suit employee needs.

Implementing and Addressing Concerns about Employee Meal Card Programs

To successfully implement a meal card program, businesses can follow these steps:

- Choose a Meal Card Provider: Select a reputable meal card provider that aligns with your company's needs, considering factors such as network coverage, features, ease of management, and costs.

- Set Up an Account: Establish an account with the chosen provider, which usually involves signing an agreement and providing necessary documentation.

- Define Meal Allowance Policies: Establish clear meal allowance policies, outlining the allocated amount, distribution frequency, eligibility criteria, and any restrictions on usage. Consider factors such as the non-taxable limit of 2200 INR per month.

- Distribute Meal Cards: Distribute the meal cards to eligible employees, providing clear instructions on how to activate and use them. Activation might involve completing KYC on the provider's portal.

- Load Funds: Regularly load funds onto the meal cards based on the defined policies.

- Educate Employees: Conduct training sessions or provide informational materials to educate employees about the benefits, tax savings, and how to effectively manage their cards.

- Monitor and Manage: Utilize the provider's platform to track spending, reload funds, and manage lost or stolen cards.

- Gather Feedback: Collect feedback from employees about their experiences with the program to identify areas for improvement.

Choosing a Provider

Choosing a reputable meal card provider is crucial for the program's success. Consider these factors:

- Network Coverage: Ensure the provider has a vast network of partner restaurants, food chains, and retail outlets, offering a wide range of food options for employees.

- Features: Evaluate the features offered by the provider, such as user-friendly platforms, mobile apps, real-time transaction tracking, customizable spending limits, and reporting capabilities.

- Cost: Analyze the provider's fee structure, including card issuance fees, transaction fees, monthly charges, and any hidden costs. Choose a program with a transparent and reasonable pricing model.

Setting Up the Program

When setting up the program, businesses should:

- Define Clear Meal Allowance Policies: Establish comprehensive policies that outline the amount allocated per meal or per month, the frequency of distribution (monthly or per pay period), and eligibility criteria based on employee roles or departments.

- Distribute Cards Effectively: Choose a convenient distribution method, such as physically handing out cards or using a digital distribution system. Ensure employees receive instructions on activating their cards and understand the program's terms and conditions.

- Educate Employees Thoroughly: Conduct informative sessions or provide comprehensive materials explaining the card's usage, benefits, tax implications, and any spending restrictions. Address potential employee concerns about security, privacy, and limited acceptance.

Meal Card Software

Using dedicated meal card software can significantly enhance program management efficiency. Essential features to look for include:

- Centralized Dashboard: Provides a comprehensive overview of program data, including card balances, transaction history, and spending patterns.

- Easy Reloading and Card Management: Enables hassle-free reloading of funds, card activation and deactivation, and management of lost or stolen cards.

- Real-Time Notifications and Reporting: Provides instant alerts for transactions, low balances, and suspicious activities, and generates detailed reports for expense tracking and analysis.

- Customizable Spending Limits and Restrictions: Allows setting spending limits per transaction, per day, or per month and implementing restrictions on specific merchants or food categories. [our conversation history]

- Integration with Payroll and Accounting Systems: Streamlines the payroll process and simplifies accounting by integrating with existing financial systems. [our conversation history]

Addressing Common Concerns about Employee Meal Cards

Anticipate and Address

Businesses and employees may have concerns about meal card programs. Addressing these concerns proactively fosters trust and encourages program adoption.

Security and Fraud

Meal card providers implement various security measures to protect against fraud and unauthorized use:

- PIN Protection: Most cards require a PIN for transactions, preventing unauthorized use if the card is lost or stolen.

- Card Blocking: Providers offer immediate card blocking options through online portals or mobile apps, enabling cardholders to deactivate their cards instantly if lost or stolen.

- Transaction Monitoring: Providers use sophisticated systems to monitor transactions in real time, detecting unusual spending patterns or suspicious activities.

- Fraud Detection Algorithms: Advanced algorithms analyze transaction data to identify potential fraud attempts and trigger appropriate security measures.

Merchant Acceptance

Meal card programs aim to ensure wide acceptance at various restaurants and food establishments:

- Partner Networks: Providers establish partnerships with a wide network of merchants, including restaurants, cafes, fast-food chains, grocery stores, and online food delivery platforms.

- Branding and Visibility: Meal card programs often have recognizable branding and are promoted to merchants, increasing their visibility and acceptance.

- Employee Feedback: Providers encourage employee feedback on merchant acceptance, expanding their networks based on employee needs and preferences.

Compliance

Meal card solutions prioritize compliance with industry standards and tax regulations:

- Tax Compliance: Providers ensure that meal card programs adhere to relevant tax laws, allowing employees to benefit from tax-free meal allowances up to specified limits.

- Data Security Standards: Meal card providers comply with industry-standard data security practices, protecting sensitive employee information and transaction data. [our conversation history]

- Regulatory Compliance: Providers stay updated on changing regulations and ensure their programs meet all applicable legal requirements.

Lost or Stolen Cards

In case of a lost or stolen card, meal card programs make reporting and replacement easy:

- Immediate Reporting: Employees should immediately report lost or stolen cards to the provider through dedicated hotlines, online portals, or mobile apps.

- Card Blocking: Providers will immediately block the reported card, preventing any further unauthorized use.

- Replacement Cards: Providers typically issue replacement cards promptly, transferring any remaining balance from the lost card to the new one.

- Zero Liability Protection: Many providers offer zero liability protection, ensuring employees are not held responsible for unauthorized transactions after reporting the loss.

Conclusion: The Power of Employee Meal Cards

Employee meal card programs offer a win-win scenario for both employers and employees, delivering a range of compelling benefits:

- For Employers:

- Streamlined Management: Replacing traditional meal vouchers or reimbursements with meal cards simplifies administration, reduces paperwork, and minimizes processing time.

- Cost-Effectiveness: Digital meal card solutions often prove more cost-effective than managing physical vouchers or handling individual reimbursements.

- Enhanced Employee Satisfaction and Retention: Offering meal cards as part of a benefits package demonstrates care for employee well-being and can contribute to increased job satisfaction and reduced turnover.

- Compliance: Reputable meal card programs ensure adherence to tax regulations, allowing employers to provide tax-free meal allowances within legal limits.

- For Employees:

- Convenience: Meal cards provide a hassle-free and cashless way to purchase food at a wide network of participating restaurants, food outlets, and online platforms.

- Tax Savings: Meal allowances received through compliant meal card programs can qualify for tax exemptions, boosting employees' take-home pay.

- Freedom of Choice: Employees enjoy the flexibility to choose from a variety of dining options based on their preferences and dietary needs.

- Financial Control: Preloaded meal cards with set limits can encourage responsible spending and budgeting for food expenses.

Ready to simplify your employee meal benefits and enhance workplace satisfaction?

Advance Technology Systems can help! We provide cutting-edge solutions for food court and canteen management, making meal card programs seamless and efficient.

Visit our website atatsonline.in/Foodcourt-Canteen-management.html to explore our comprehensive range of services and discover how we can help you implement a successful employee meal card program tailored to your organization's unique needs.

FAQs about meal cards:

- What are meal cards?

Meal cards are employer-provided prepaid cards that are similar to debit cards. Employees can use them to buy food and groceries at a variety of places. Think of them as a dedicated card just for food expenses.

- Why are meal cards important for businesses?

Meal cards can make employees happier in a few ways. First, they offer tax benefits, which can increase take-home pay. Second, they streamline food expenses by providing a separate card just for those costs. This can make budgeting and tracking easier. Finally, offering a meal card shows employees that their company cares about their well-being, making for a more attractive benefits package.

- What are the main advantages of meal cards for employees?

The sources list several advantages for employees, including:

- Tax Benefits: Meal cards are often exempt from income tax up to a certain limit. This reduces your taxable income and can mean more money in your pocket.

- Convenience: Meal cards eliminate the need to use cash or your personal debit card for food purchases. This can simplify expense tracking and budgeting.

- Freedom of Choice: You can use your meal card at a network of restaurants, food chains, and retail outlets, offering a variety of food options.

- Reduced Lunch Stress: You can save time and effort by ordering food with your meal card instead of packing lunch every day.

- Food Expense Management: Meal cards come with preset limits, helping you manage your food spending.

- No Reimbursement Hassle: You don't need to go through a reimbursement process for food purchases made with your meal card.

- Easy Management: You can easily manage your meal card online, check your balance, and see when it expires.

- How can meal cards benefit employers?

From an employer's perspective, here are some of the benefits of offering meal cards:

- Employee Retention: Offering meal cards as part of a compensation package makes it more attractive and can help retain employees.

- Increased Productivity: Employees who don't have to worry about preparing lunch can focus more on their work.

- Easy Management: Employers can streamline meal allowances and reduce the hassle of food coupons and reimbursements.

- Competitive Advantage: In a competitive job market, offering meal cards can set a company apart and make it more appealing to potential hires.

- Are there different types of meal cards?

Yes, the sources describe three main types:

- Prepaid Meal Cards: These are general-purpose cards that can be used at various restaurants, convenience stores, and food outlets. They offer employees the most flexibility.

- Employer-Provided Meal Cards: These cards are offered through partnerships between employers and specific restaurants or food providers. They can only be used at the designated locations.

- Restaurant-Specific Meal Cards: These cards are issued for use at a company's in-house cafeterias or dining facilities. They are the most restrictive in terms of usage.

- Are meal cards taxable?

Meal cards are generally not taxable. However, in India, if the amount spent on meals exceeds the non-taxable limit of 2200 INR per month, the excess amount becomes taxable under Section 17(2)(viii) of the Income Tax Act.

How can meal cards help prevent fraud?

Meal cards have security features that can help prevent fraud. They typically require a PIN for transactions, making it difficult for unauthorized users to make purchases, even if they find a lost card. Additionally, the finance team can easily block a card that's been reported lost, preventing any further fraudulent activity.

Cashless Card Payment System for Canteen and Food Court

Upgrade your establishment with our Prepaid Card Software and take your business to the next level.

If you want to more information, You can reach us by phone at +91 9810078010 or by email at ats.fnb@gmail.com. Or just visit: https://www.foodcourtbilling.com